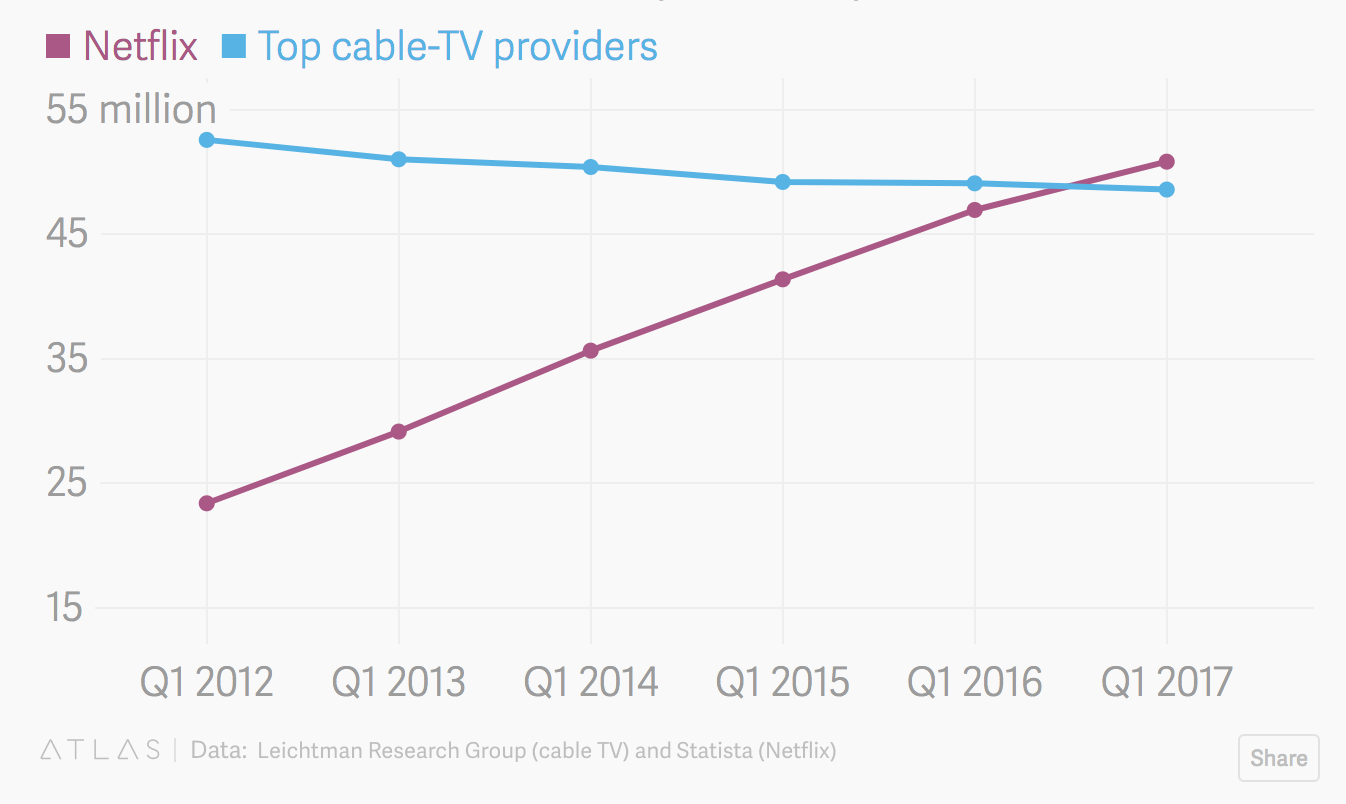

We have become accustomed to a world that is content-intensive. Everyone needs something to read, look at, or view by using the internet which has now become an accessible commodity for most. Companies have tapped into the resourceful internet to garner a whole new audience base that can watch their content and increase viewership. Using online forums that attract customers has become the new business and has led the doors open for new and creative marketing schemes to entice the audience. There is one company that has advanced greatly in the internet domain and effectively ended everything that cable TV had brought with it in recent times and its name is Netflix.

The profit margin presented by this company the previous year was a huge 11.7 billion dollars. For a company that has been gaining popularity in the past 3-4 years, this number is huge and it is safe to say that a company Netflix is on the rise. The shares of Netflix have become available for grabs since the company went public and has had a continuous streak of success. They bring in the best actors from all over the world for their top-notch movie and TV series productions. They have also engaged in developing region-specific content which contains actors that are familiar to most people from that region and have been able to cater to the demands of people from various regions. This has been instrumental in bringing them huge chunks of success.

The wise option is to keep an eye on the earnings date of Netflix which is coming up soon. Investing in the company is a good option and you should buy their stocks soon for a long-term profit.

All about the Netflix earnings calendar

- The earnings date for Netflix is approaching fast and is predicted to be around 16th You should look for more and more opportunities to invest and plan your strategies around the same soon and use stock market tools to check your strategies.

- The volume of trade has risen to 6-7 more times during the earnings date than regular days. The Predicted Moves After Earnings Announcement (PMAEA) that is an important entity. This number represents a percentage of the stock movement after the earnings date has been announced and it is set at 12%. The volatility of the stock is more this year and this means you must look at the strike price which is double the PMAEA at 24%. This means that the stock price is highly unlikely to reach that number, but in case it does, you must buy the stocks in advance.

- This number is accurate because analysts spend their time sifting through and analyzing series of historical data in chunks for several months before the numbers are displayed. This number has several factors such as the values and fundamentals of the company, its past performance numbers, and the company performance. Once these numbers are procured, you must back-test the numbers to ensure accuracy when you apply your strategies.